What’s been happening with WhatsApp?

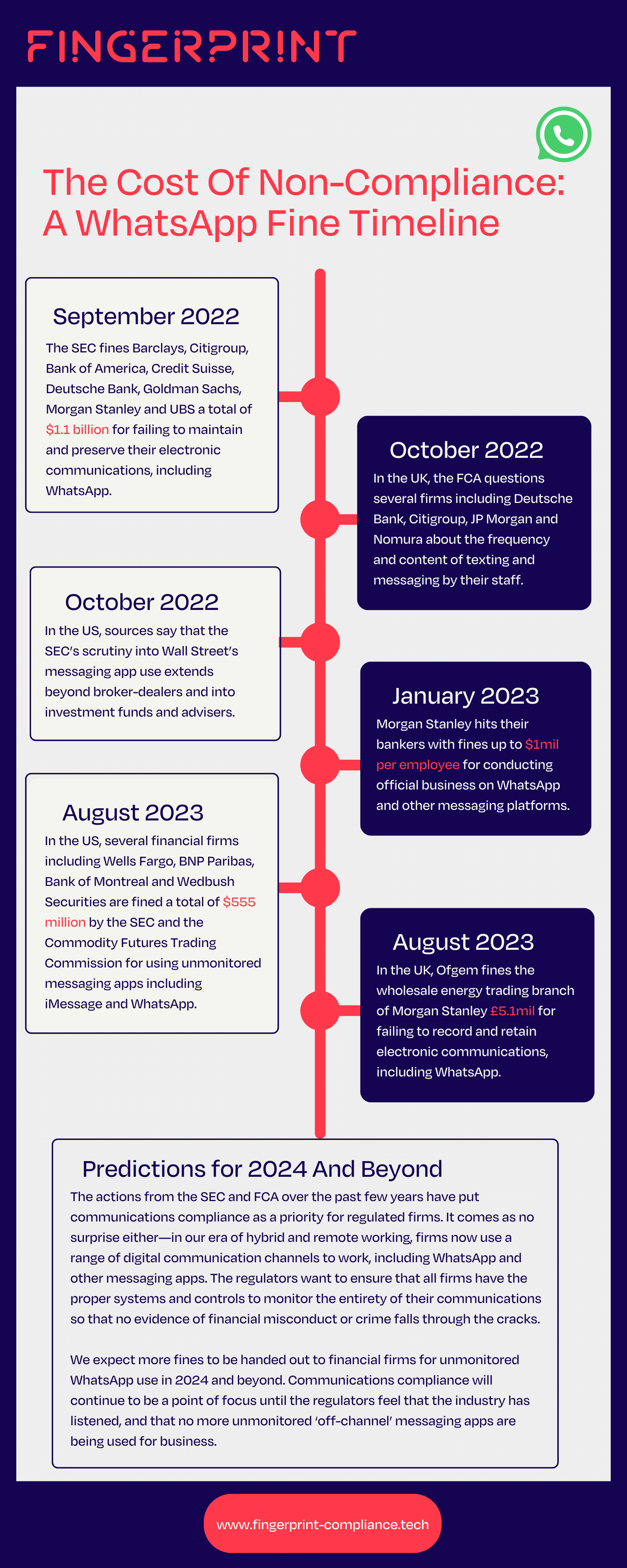

Over the past few years, major banks such as the Bank of America, Goldman Sachs, Morgan Stanley and HSBC have been handed fines totalling billions of dollars for using WhatsApp and other mobile messaging apps without monitoring them, which violates regulatory requirements from multiple global regulators.

In response to these fines, many firms have completely banned the use of WhatsApp at work… but is this the right answer? With technology solutions available to monitor WhatsApp and other messaging apps, firms now have the choice to invest in this RegTech to allow the use of these apps while still adhering to regulations.

So, should your own firm invest in RegTech to allow the use of WhatsApp and other messaging apps at work, or is it better to ban these apps outright?

We explore both sides of the issue and get input from key compliance voices in the industry—Neil Patel at Effecta Compliance Limited and Emma Parry at NovaFin Consulting—to see whether firms should use or ban mobile messaging apps. Let’s dive in…

Sections:

- The Cost Of Non-Compliance: A WhatsApp Fine Timeline

- Why Are Mobile Messaging Apps So Popular In Business?

- Should Your Firm Use Or Ban Mobile Messaging Apps?

- Invest In The Right RegTech To Monitor WhatsApp & Use Compliance To Enable Business

The Cost Of Non-Compliance: A WhatsApp Fine Timeline

Views From The Industry: Do You See Communications Compliance As A Point Of Focus For The Regulators In 2024 & Beyond?

Neil Patel, Compliance Consultant at Effecta Compliance Limited, says:

“In recent times, the SEC in particular have been fining major Banks for failing to record employee communications. So there is definitely a focus on communications compliance. With a lot of businesses using mobile messaging apps for business purposes, there will come a point in time where the regulators will have no choice but to set out mandatory standards. The FCA are aware of the risks carried out when using devices which are unmonitored or encrypted, and the harm it can cause to the market.”

Emma Parry, Founder & CEO of NovaFin Consulting, says:

“With continued market volatility caused by geo-political instability, and the fact that 2024 will be a historic election year with more than two billion voters set to go to the polls in 50 countries, I expect the regulators to continue to prioritise market surveillance – be it, trade or eComms.”

“But it’s not just regulators such as the UK FCA. In August 2023, Morgan Stanley was fined £5.41m by Ofgem after energy traders were found to have discussed business transactions over WhatsApp. In its statement, Ofgem noted that the failure to record all eComms channels risked a ‘significant compromise of the integrity and transparency of wholesale energy markets’.”

“If anything, I would expect increased focus, rather than less!”

Why Are Mobile Messaging Apps So Popular In Business?

There is an interesting question that comes from these fines: why are mobile messaging apps so popular within these financial firms?

Using messaging apps like WhatsApp and iMessage offers an easy way for employees to communicate with their clients, and with each other. It’s much easier to send messages over WhatsApp while employees are out of the office, which offers a much quicker way of doing business.

There are many benefits to using WhatsApp for clients too, who will appreciate getting quick responses via messaging as opposed to waiting until the next day if employees must go back to the office to respond. Using these messaging apps can help enable more business—in a fast-moving financial world, waiting even a couple of hours for a response or to check on the progress of a stock can hinder deals.

Not to mention the ability to nurture relationships well on WhatsApp too. Think of the casual nature of the app and the many jokes and conversations that can be had, as opposed to the cold and official nature of emails. It allows employees to deepen their relationships with their clients more quickly, which can really help business thrive.

Views From The Industry: Why Are Messaging Apps So Popular In Financial Firms?

Neil Patel, Compliance Consultant at Effecta Compliance Limited, says:

“We live in a modern era, everywhere you look everyone has a mobile phone. To stay connected and communicate with family and friends, the vast majority of people use mobile messaging apps like WhatsApp for their personal use. No wonder this has shifted to the business world. With everyone having access, instant mobile messaging apps makes it much more convenient for employees to conduct business. Efficient communication, with messages being sent and received in real time in addition to location not being an issue, it’s no wonder why more people are using WhatsApp for business purposes.”

Emma Parry, Founder & CEO of NovaFin Consulting, says:

“The overwhelming driver will be client preference in using instant messaging apps combined with the fact that these apps have proliferated over the past few years. Not just in financial services, but in our everyday lives. Increasingly, we prefer texting to actually picking up a phone and speaking with someone. Add to this the speed and efficiency of sending a quick text, and it’s easy to see why messaging apps continue to flourish.”

Should Your Firm Use Or Ban Mobile Messaging Apps?

With technology solutions available to monitor WhatsApp and other messaging apps, it’s up to your firm to decide whether the investment in these solutions is worth the added flexibility in communicating. Invest in the right RegTech, and you could help your clients communicate in the ways that best suit them and gain a reputation as a business that operates in modern ways, keeping up with the rapid pace of a digital world.

After all, there is a reason the use of mobile messaging apps has been so prevalent across many firms. Banning these apps could mean much slower response times for your clients, which could become a big blocker to business.

However, if you prefer to avoid the use of messaging apps because you do not have the resources to monitor them, then that is totally understandable. Just make sure that your compliance team are properly monitoring your traditional communication channels such as voice calls and emails to adhere to your communication monitoring regulations.

Views From The Industry: Do You Think That Financial Firms Should Allow Their Employees To Use Mobile Messaging Apps Like WhatsApp At Work If Properly Monitored?

Neil Patel, Compliance Consultant at Effecta Compliance Limited, says:

“Let’s be honest, whether firms allow the use or ban employees from using mobile messaging apps, it will happen. So if it is going to happen then why not just allow the use? I’m all up for employees using WhatsApp to conduct their business. However, firms must ensure that if they do allow this, they must have sufficient oversight and monitoring capabilities along with a reliable tool. All conversations, all exchanged media/files must be monitored and everything must be accessible to the employers.”

“If the use of WhatsApp is permitted, firms should ensure there is a Policy and guidelines in place which clearly articulates the expectations and what is deemed as acceptable use. The Policy should also ensure that it states the consequences for violations. A key challenge for employers and employees will be separating out business and personal messaging, a topic which will become very relevant as we think about conduct but also privacy issues.”

Emma Parry, Founder & CEO of NovaFin Consulting, says:

“The challenge isn’t so much the communication methods, or indeed the record keeping obligations, it’s the need for firms to be able to investigate potential misconduct. Firms must have the resources and capabilities in place to analyse disparate structured and unstructured data. They need to be able to reconstruct a series of events relating to a transaction, and fundamentally, they need to be able to prove, one way or another, if market abuse has taken place.”

“Given the monitoring, control and investigative challenges, and the UK FCA’s comment in 2022 around the difficulty in proving market abuse, it’s unsurprising that many firms have decided to ban certain instant messaging apps entirely.”

“My stance on messaging apps is ‘USE’. But only if effective monitoring and investigative capabilities are in place!”

Invest In The Right RegTech To Monitor WhatsApp & Use Compliance To Enable Business

If you’d like to enable your employees to use messaging apps at work, then talk to your compliance team to see what regulatory technology you can invest in to monitor these apps. So you can help your staff communicate flexibly while keeping your operations fully compliant.

We provide a solution with SnippetSentry which allows regulated firms to monitor WhatsApp and other messaging apps on the Fingerprint platform, alongside your usual communications like email and voice calls. All in one dashboard, with all the investigation and reporting tools needed for your compliance team to shine.

Manish Kalra, Product Marketing Leader at SnippetSentry, says:

“Increasingly, companies are embracing WhatsApp as a method of communication because it is now the preferred form of communication for many customers. As businesses, we want to meet our customers where they want to do business—not change their behavior to meet our needs. Partnering with Fingerprint enables our joint customers to achieve compliance and meet regulatory obligations so they can focus on growing their businesses.”

If your firm is interested in using WhatsApp and other messaging apps above board, then get in touch. We’d love to help.

This article was originally published on the Fingerprint LinkedIn newsletter. Subscribe to the newsletter and follow the Fingerprint LinkedIn page to get up to date with the latest articles, opinion pieces & industry news on communications compliance in the financial industry.